Fidelity Stock Transfer SM

Fully supported onboarding from IPO and beyond

From product demo to closing call, our dedicated team can support you every step of the way.

How we make it easy

Dedicated support

Partner with client counsel

Inform shareholders

How it works

It’s never too early to find a transfer agent

Many companies choose to start their transfer agent process around the time they’re filing their Form S-1, but it’s never too early to start. We like to schedule short check-ins at least 12 weeks before your IPO.

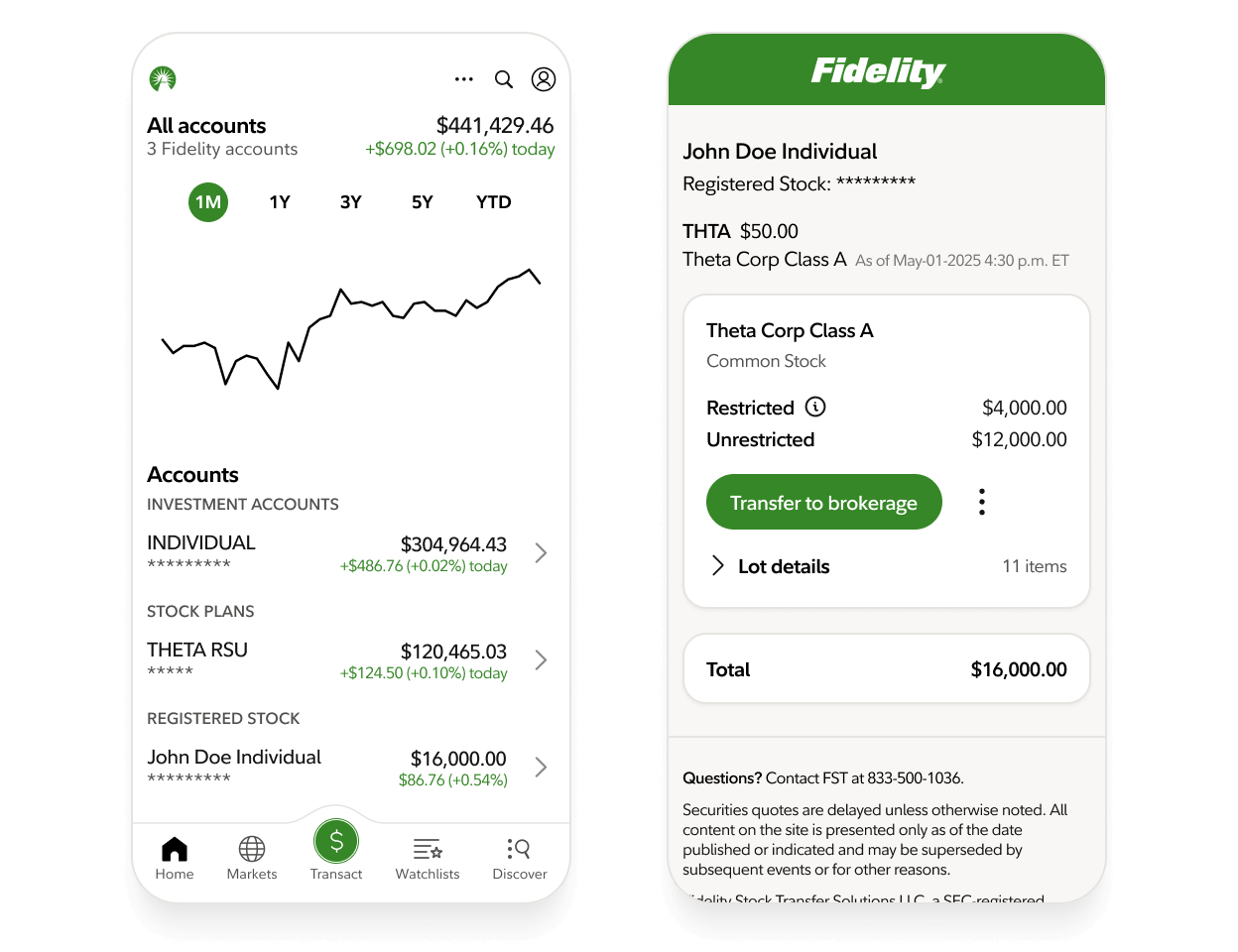

Instant access from day one

From day one of the IPO and beyond, your shareholders that sign up for digital access will have instant access to their information about their registered stock, including their cost basis, amount owned, and any restrictions—all with one login.

Frequently asked questions

What is a transfer agent?

A transfer agent provides services for an issuer of securities, like maintaining records of ownership, protecting against over- and under-issuances of securities, and providing corporate communications to securityholders.

The transfer agent acts as a liaison between an issuer and its shareholders. In some cases, the transfer agent facilitates transactions with a broker so investors can sell their securities.